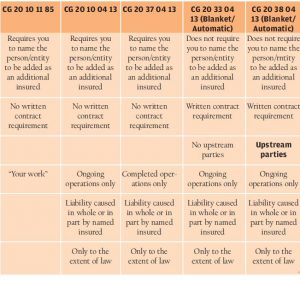

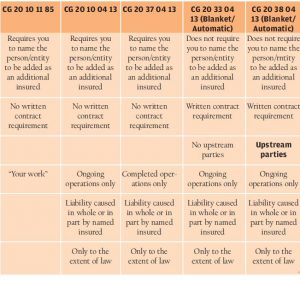

A careful review of additional insured endorsements is essential to protect those looking for coverage as additional insured.

If someone is told that they just need to be named as an additional insured to protect themselves in a construction project, they may need more information. Does the person want to be an additional insured for ongoing or completed operations? Do they have a written contract agreement? Do they want coverage from subcontractors?

The most common additional insured endorsement for contractors is the CG 20 10.

The CG 20 10 changed significantly after the November 1985 edition. In the November 1985 edition – called the CG 20 10 11 85 – the entity being added as an additional insured was only an insured “with respect to liability arising out of ‘your work.’” The “your work” refers to the work of the named insured – that is, the contractor. “Your work” includes the contractor’s ongoing operations and completed operations.

After 1985, the entity being added as an additional insured using the CG 20 10 was only an insured “with respect to liability … caused … by your ongoing operations.” “Ongoing operations” does not include completed operations. Therefore, the change from “your work” in the CG 20 10 11 85 to “ongoing operations” in later versions effectively removed completed operations coverage for the additional insured.

Sample Ongoing Operations Occurrence

To understand the effect of this change, imagine a property owner hiring a contractor to build a brick wall. While building the wall, the contractor drops a load of bricks on top of a line of cars. This causes property damage arising out of the contractor’s ongoing operations. The car owners sue the property owner.

If the property owner was named as an additional insured on the contractor’s CGL policy using CG 20 10 11 85, the property owner should be covered. This is because the CG 20 10 11 85 provides coverage for liability arising out of “your [the named insured/contractor’s] work,” and “your work” includes both the named insured’s ongoing and completed operations. If the property owner was named as an additional insured using the CG 20 10 after 1985, the property owner would also be covered as an additional insured on the contractor’s policy because the CG 20 10 after 1985 provides coverage for ongoing operations, and this was an ongoing operations exposure.

Sample Completed Operations Occurrence

Two months after the contractor finishes the wall, the wall falls on a line of cars. This is property damage out of the contractor’s completed operations. Once again, the car owners sue the property owner.

If the property owner was named as an additional insured using the CG 20 10 11 85, the property owner would have coverage for the completed operations exposure as “your work.” If the property owner was named as an additional insured using the CG 20 10 with an edition date after 1985, the property owner would not have coverage for the completed operations exposure under the contractor’s CGL policy. The CG 20 10 after 1985 does not provide coverage to the additional insured for completed operations. It only provides coverage for ongoing operations, and this was a completed operations exposure.

Additional Insured Endorsement CG 20 37: Completed Operations

To address the CG 20 10’s gap in completed operations coverage after 1985, the Insurance Service Office (ISO) created CG 20 37 Additional Insured – Owners, Lessees or Contractors – Completed Operations. As the name implies, this endorsement provides coverage to the additional insured for completed operations. It does not provide coverage for ongoing operations.

Using our wall example, if the contractor named the property owner as an additional insured using CG 20 37 (Completed Operations), there would be no coverage for the sample ongoing operations occurrence. There would only be coverage for completed operations exposures. The CG 20 37 is not necessary if a business is able to get the CG 20 10 11 85 because the CG 20 10 11 85 provides coverage for “your work,” and “your work” includes both the ongoing operations of the current CG 20 10 and the completed operations of the current CG 20 37.

Blanket Additional Insured Endorsements

“Blanket” – also called “automatic” – additional insured endorsements are endorsements that the insurance company provides to automatically add as additional insureds, those individuals or entities 1) for whom the named insured is performing operations, and 2) with whom the named insured has agreed in writing to name as an additional insured. A positive feature of the blanket endorsement is insurance agencies can often send out these endorsements without requesting permission from the insurance carriers. This often makes the blanket endorsements quicker to process. A negative feature is the written contract requirement.

Blanket Additional Insured Endorsement CG 20 33 Additional Insured–Owners, Lessees or Contractors–Automatic Status When Required in Construction Agreement with You

The blanket additional insured that most resembles the CG 20 10 is the CG 20 33. A significant difference between the CG 20 10 and CG 20 33, is CG 20 33’s requirement that there must be a written contract or agreement between the additional insured and the named insured. As a way to explain the significance of the written contract requirement, imagine a custom home building project. For this project there is an owner, a general contractor and 15 subcontractors.

General Contractor signs a written contract to build a house for owner. The contract requires the general contractor to have a CGL policy that names the owner as an additional insured. The contract also requires all subcontractors to have a CGL policy that names the owner as an additional insured.

The general contractor hires 15 subcontractors to help with the project. The general contractor and each subcontractor sign a written contract. The contract requires each subcontractor to name general contractor and owner as additional insureds on the subcontractors’ CGL policies. Each subcontractor sends the owner an endorsement showing the owner is an additional insureds on the subcontractors’ CGL policies using blanket CG 20 33.

The problem with this scenario is that there is no written contract between the owner and the subcontractors. The CG 20 33 requires a written contract between the named insured and the additional insured.

Imagine that there is a massive claim at the job site and the owner is sued. The claim involves the work of the 15 subcontractors. The owner thinks he or she is an additional insured with direct rights to the 15 subcontractor CGL policies. What the owner really has are 15 pieces of paper from 15 subcontractors saying owner is named as an additional insured using CG 20 33.

The CG 20 33 required a written contract between the additional insured and the named insured. There was no written contract between the owner and subcontractors.

One way to avoid the owner’s situation would have been for the owner to be named as an additional insured using CG 20 10. The CG 20 10 does not require a written contract between the named insured and additional insured. A second solution would have been for the owner to enter a written contract with each subcontractor. A third option would have been for the owner to be named on the subcontractors’ policies using CG 20 38.

Blanket Additional Insured Endorsement CG 20 38 Additional Insured–Owners, Lessees or Contractors–AUTOMATIC STATUS FOR OTHER PARTIES WHEN REQUIRED IN WRITTEN CONSTRUCTION AGREEMENT

The primary distinction between the CG 20 33 and the CG 20 38 is that the CG 20 38 provides coverage for upstream parties. Upstream parties are the entities or individuals above the level where an entity is contracting. Whereas the CG 20 33 only provides additional insured status where there is a direct written contract, the CG 20 38 extends coverage to “any other person or organization you are required to add as an additional insured under the contract or agreement.”

Using our custom home example, the subcontractors signed a contract with the general contractor saying they would name the general contractor and owner as additional insureds, but the subcontractors did not sign a contract with the owner. There was no coverage for the owner under the subcontractors’ policies when they used the CG 20 33 because the CG 20 33 requires a written contract between the named insured and the additional insured. If the subcontractors used the CG 20 38, the owner would have additional insured status because the owner is a “person or organization [the named insured is] required” to add as an additional insured under the contract with the general contractor.